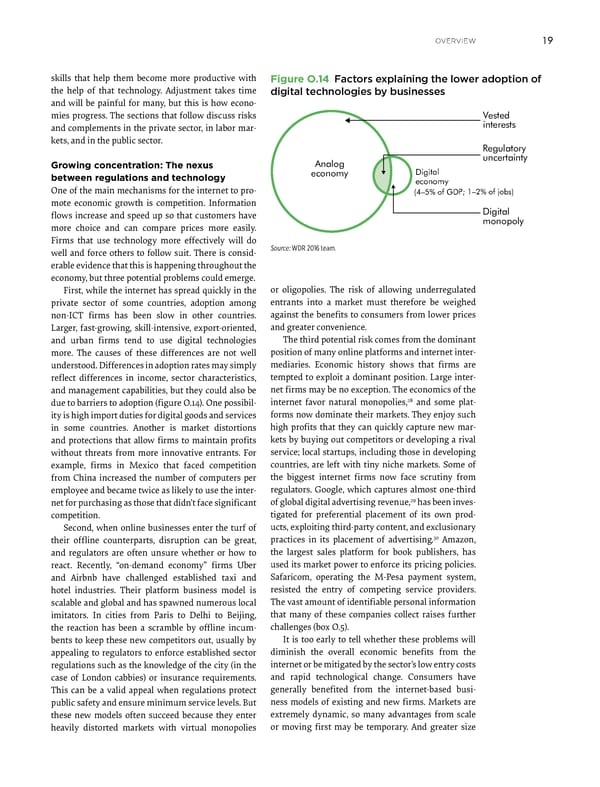

overview 19 skills that help them become more productive with Figure O.14 Factors explaining the lower adoption of the help of that technology. Adjustment takes time digital technologies by businesses and will be painful for many, but this is how econo- mies progress. The sections that follow discuss risks Vested and complements in the private sector, in labor mar- interests kets, and in the public sector. Regulatory uncertainty Growing concentration: The nexus Analog between regulations and technology economy Digital economy One of the main mechanisms for the internet to pro- (4–5% of GDP; 1–2% of jobs) mote economic growth is competition. Information flows increase and speed up so that customers have Digital more choice and can compare prices more easily. monopoly Firms that use technology more effectively will do well and force others to follow suit. There is consid- Source: WDR 2016 team. erable evidence that this is happening throughout the economy, but three potential problems could emerge. First, while the internet has spread quickly in the or oligopolies. The risk of allowing underregulated private sector of some countries, adoption among entrants into a market must therefore be weighed non-ICT firms has been slow in other countries. against the benefits to consumers from lower prices Larger, fast-growing, skill-intensive, export-oriented, and greater convenience. and urban firms tend to use digital technologies The third potential risk comes from the dominant more. The causes of these differences are not well position of many online platforms and internet inter- understood. Differences in adoption rates may simply mediaries. Economic history shows that firms are reflect differences in income, sector characteristics, tempted to exploit a dominant position. Large inter- and management capabilities, but they could also be net firms may be no exception. The economics of the 28 due to barriers to adoption (figure O.14). One possibil- internet favor natural monopolies, and some plat- ity is high import duties for digital goods and services forms now dominate their markets. They enjoy such in some countries. Another is market distortions high profits that they can quickly capture new mar- and protections that allow firms to maintain profits kets by buying out competitors or developing a rival without threats from more innovative entrants. For service; local startups, including those in developing example, firms in Mexico that faced competition countries, are left with tiny niche markets. Some of from China increased the number of computers per the biggest internet firms now face scrutiny from employee and became twice as likely to use the inter- regulators. Google, which captures almost one-third of global digital advertising revenue,29 net for purchasing as those that didn’t face significant has been inves- competition. tigated for preferential placement of its own prod- Second, when online businesses enter the turf of ucts, exploiting third-party content, and exclusionary practices in its placement of advertising.30 their offline counterparts, disruption can be great, Amazon, and regulators are often unsure whether or how to the largest sales platform for book publishers, has react. Recently, “on-demand economy” firms Uber used its market power to enforce its pricing policies. and Airbnb have challenged established taxi and Safaricom, operating the M-Pesa payment system, hotel industries. Their platform business model is resisted the entry of competing service providers. scalable and global and has spawned numerous local The vast amount of identifiable personal information imitators. In cities from Paris to Delhi to Beijing, that many of these companies collect raises further the reaction has been a scramble by offline incum- challenges (box O.5). bents to keep these new competitors out, usually by It is too early to tell whether these problems will appealing to regulators to enforce established sector diminish the overall economic benefits from the regulations such as the knowledge of the city (in the internet or be mitigated by the sector’s low entry costs case of London cabbies) or insurance requirements. and rapid technological change. Consumers have This can be a valid appeal when regulations protect generally benefited from the internet-based busi- public safety and ensure minimum service levels. But ness models of existing and new firms. Markets are these new models often succeed because they enter extremely dynamic, so many advantages from scale heavily distorted markets with virtual monopolies or moving first may be temporary. And greater size

World Development Report 2016 Page 32 Page 34

World Development Report 2016 Page 32 Page 34